Do all Businesses need Accounting Software? What are the Options?

The idea of accounting software is to enable the efficient and fast processing of financial transactions.

Most software is cloud-based and enables businesses to be able to access their accounts from anywhere in the world and normally includes a phone app that lets you use most functions of the software so that you can invoice on the go etc.

One of the benefits of online software is that you can give your accountant direct access to accounts through the online application rather than a manual transfer of files when they need access.

Accounting software leads to the automation of processes and a reduction of staff costs or a restructure of staffing duties as those who would previously be engaged in manual processing of data now have more time for other tasks.

Any software that is being considered should at least have basic reports such as a profit or loss and balance sheet. As the reports generated help an organisation get an idea of how they are performing financially and allows companies to create budgets and cashflow forecasts. Records will become more accurate as there will be a reduction in human error and records are automatically kept up to date.

Below is a list of the advantages and disadvantages of accounting software as well as features that should be considered when looking for a package.

Advantages

- Provides financial reports for better decision making

- Reduction of manual errors due to automation

- Reduction in staff costs on manual accounting

- Multiple users have access to the accounting data

- Enables scalability as a business grows

Disadvantages

- Loss of accounting data can paralyze an organisation

- False financial reports if errors made during data entry

- Initial costs can be high for an organisation if they need to purchase the software etc.

Features

- Invoicing and billing – creation of quotes and invoices and sending of payment reminders to customers

- Payroll – handles all payroll calculations including deductions, PAYE, leave calculations and pay slips or has an add on that can provide this.

- Reporting – Reports include Profit or Loss, Balance Sheet, Trial balance and account reports that show the companies’ position.

- Inventory management – records all sales and purchases on inventory or allows items to be added for sale but no tracking

- Some CRM (customer relationship management) aspects – handles your customer list and records all sales or purchases from suppliers

- Automates GST calculations and filing – ensuring you are always up to date with your tax obligations.

Finding the right software for your business will centralise many aspects of your business in one place. This saves time and money as you won’t need to purchase extra software to do things such as invoicing etc.

Whether you need software or not will depend on how many transactions your business has during the year. The best option will depend on what you need the software to do. If you only have a few invoices each year an invoicing app could suit without needing a full accounting system. If you are GST registered the use of a software that has GST settings is important as I have seen people be reviewed by IRD for doing GST just on their bank statements and with some very strange methods ending with them owing thousands as they managed to double claim amounts.

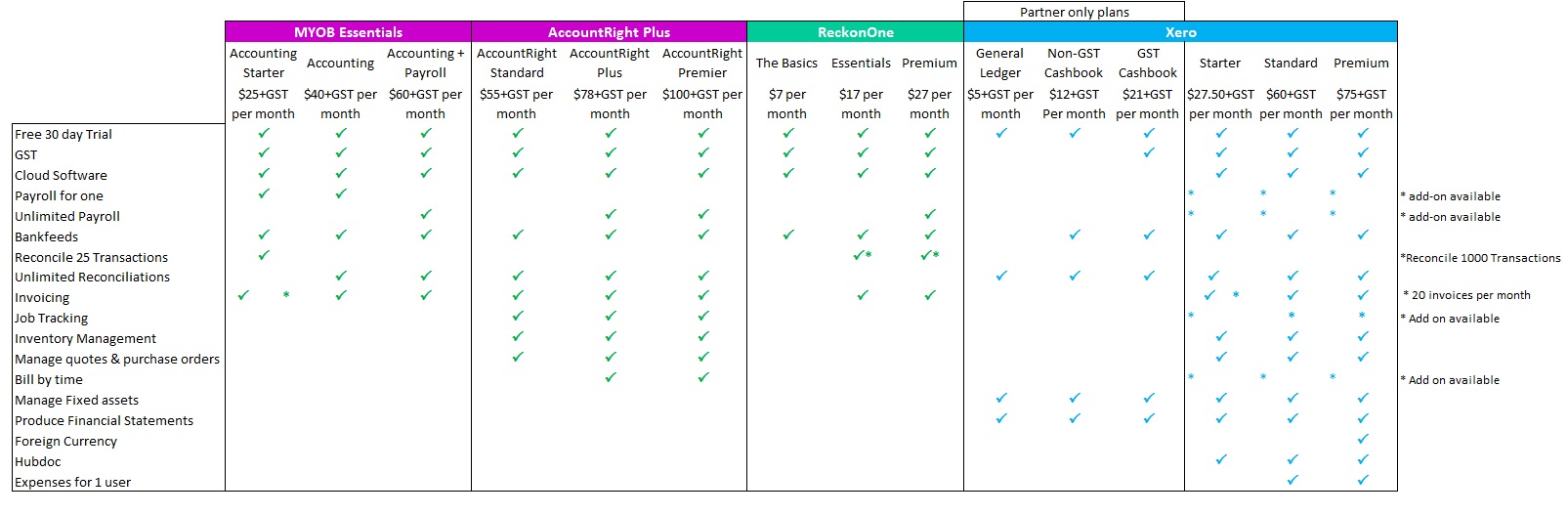

Each software has its good and bad points. Some of the common options are listed below.

MYOB has good Job costing functions built into their software and at one time was the only real option for software. Bankfeeds can be connected and there are quite a few options in packages, however, I have heard from clients that the software can be hard to use and not as user friendly as other options available today. Does not have a fixed asset register so this would need to be maintained separately and depreciation calculated manually.

MYOB has good Job costing functions built into their software and at one time was the only real option for software. Bankfeeds can be connected and there are quite a few options in packages, however, I have heard from clients that the software can be hard to use and not as user friendly as other options available today. Does not have a fixed asset register so this would need to be maintained separately and depreciation calculated manually.

Reckon was QuickBooks and has now evolved to cloud based software for small to medium and large businesses, with the added options of POS systems and more.

Reckon was QuickBooks and has now evolved to cloud based software for small to medium and large businesses, with the added options of POS systems and more.

They also have a free invoice app that can be downloaded on your smartphone. An unlimited amount of invoices can be sent and can be customised to your business. More info can be found here. The software itself isn’t one that I use

I use Xero everyday and find it is the easiest software for clients to learn and has access to 800+ Add ons/integrations to expand the products to meet most business’s needs. They provide great GST reporting and calculations so hours aren’t spent calculating GST and ensures what is filed is correct or if a transaction needs to be edited the change is recorded in the next return.

I use Xero everyday and find it is the easiest software for clients to learn and has access to 800+ Add ons/integrations to expand the products to meet most business’s needs. They provide great GST reporting and calculations so hours aren’t spent calculating GST and ensures what is filed is correct or if a transaction needs to be edited the change is recorded in the next return.

This is the software that I would recommend to any new business that needs an accounting system as it can grow with your business, is easy to use and allows your accountant access to up to date numbers when required. Also, end of year financial reports can be completed through Xero. Check out the spotlight on apps post which will come out on Friday to explore more features that Xero offers.

Wave is not the best option in software, if you need a Free option this will be fine to record your data. The payroll function is not great neither are the GST calculations for New Zealand from the reviews I have seen however it is great for invoicing if you don’t have any software. Has all the basic reports available P&L, Balance Sheet and cashflow statement. However, it also does not have a fixed asset register so this would need to be maintained separately and depreciation calculated manually. When this article was first published in mid 2020 Wave was available in all countries however is now unsupported in most outside North America. If you had wave you can still use it however it will only let you open new American ledgers now.

Wave is not the best option in software, if you need a Free option this will be fine to record your data. The payroll function is not great neither are the GST calculations for New Zealand from the reviews I have seen however it is great for invoicing if you don’t have any software. Has all the basic reports available P&L, Balance Sheet and cashflow statement. However, it also does not have a fixed asset register so this would need to be maintained separately and depreciation calculated manually. When this article was first published in mid 2020 Wave was available in all countries however is now unsupported in most outside North America. If you had wave you can still use it however it will only let you open new American ledgers now.

Accounting software is not a one size fits all product, some businesses will need even larger systems I have just provided some of the options available in NZ for smaller businesses. It is best if you already have an accountant to speak to them about what is the best option or most have free trials so you can try all the features and work out the package that works best for you. I have included a comparison chart with features of different software below as a starting point.