Xero

Xero is a New Zealand based accounting software that includes ample reports and 800+ app integrations. There are no annual contracts as it is subscription based and you can cancel your subscription at anytime. Xero offers a 30 day free trial and a fully functioning Demo company so you can try out all features before subscribing to help you decide which subscription is best for your business.

The software is best suited for small to medium sized businesses. I have had clients that have large businesses use the software however it depends entirely on the business and extra addons that can be used. If you have a large complex inventory then you will need a software more suited to your industry or an inventory addons such as unleashed etc.

Advantages

- Unlimited users access

- Numerous integrations

- Suited for small to medium businesses

- Double-entry accounting

- Advanced features

- Cloud software

Disadvantages

- Lack of phone support – contact support via email/xero software only

Even though you cannot phone xero for support your accountant/bookkeeper or Xero central will normally be able to answer your question. If not and xero support is the only way you can contact them through your xero account and they are normally very quick to reply. Xero central provides support articles that cover common questions and how to use the software effectively. There are also training videos and quarterly updates on new product releases and updates.

The software allows access by unlimited users for each subscription and allows you to set different permission levels depending on what you want your staff to be able to access. The different user roles and permissions are below and more info is available here.

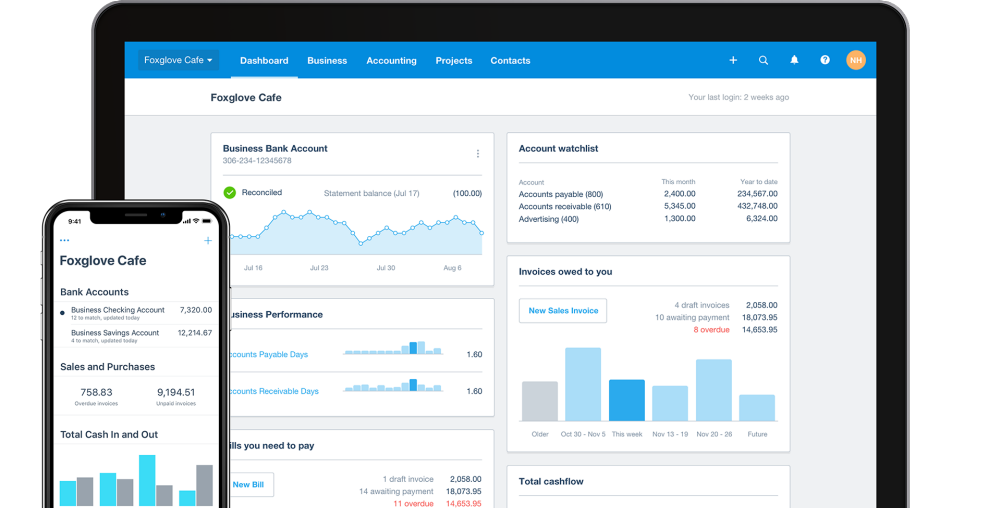

There is a customisable dashboard that features graphs, bank accounts, invoices owed to you and bills to pay. Business performance ratios and graphs can also be added so you can check your gross profit at a glance.

A standard invoice template for invoicing is provided however this can be extensively customised to suit your needs. Xero offers quite a few time saving necessities including, recurring invoices, automatic invoice reminders and default payment settings. Credit notes and statements are also easily created through the sales screen and can be emailed from xero directly to your customers.

Payment services can be connected to your invoicing to get paid sooner by accepting payments through paypal and stripe etc.

The contacts section allows you to add basic client information, discounts, payment settings and supplier details.

Fixed assets are fully managed through xero. Depreciation is run through the fixed asset register so no manual calculations are necessary, the correct depreciation rate just needs to be entered for each asset.

All your reporting needs will be covered within the reporting section. There are reports covering everything from sales and budgeting to cashflows. All reports are fully customisable to suit your needs and reporting requirements. Tracking categories are available and help to customise reports further, categories normally created are region, locations, departments etc. This is a handy feature for people with multiple rental properties, especially with the new rental rules, it allows you to track all rent and expenses for each rental.

Reports can be run on both accrual and cash basis depending on your reporting needs.

If you require multiple currencies for your business for overseas purchases Xero will automatically track the foreign exchange gains and losses over multiple currencies.

Xeros mobile app lets you capture expenses, invoice and reconcile while you’re on the go.

If you do use Xero and are looking for an accountant ensure that they are going to also complete your end of year accounts in Xero. This ensures your financial information is always up to date and you aren’t working from incorrect figures. I know of many accounting firms who use the figures from client’s Xero accounts and move the information into other systems to complete the end of year accounts and do not align the clients’ Xero accounts. This means you could be looking at loans thinking they are almost paid off and the figure to pay in the bank is completely different as the interest expense has never been journaled in.

I have found through working with many businesses that this software is perfect for many types of businesses and is easy for most people to use. I have heard from people that they wished they had swapped software sooner as the time savings are worth it and it just helps to make their businesses to run smoother. I do recommend this software due to its many features it is an all in one package.

If you want to learn more about Xero and how to use it, check out our Courses section as there are several Xero courses including Xero Basics for Business. The course goes through all the basic functions of xero and can be rewatched at anytime.