Covid Small Business Cashflow Loan

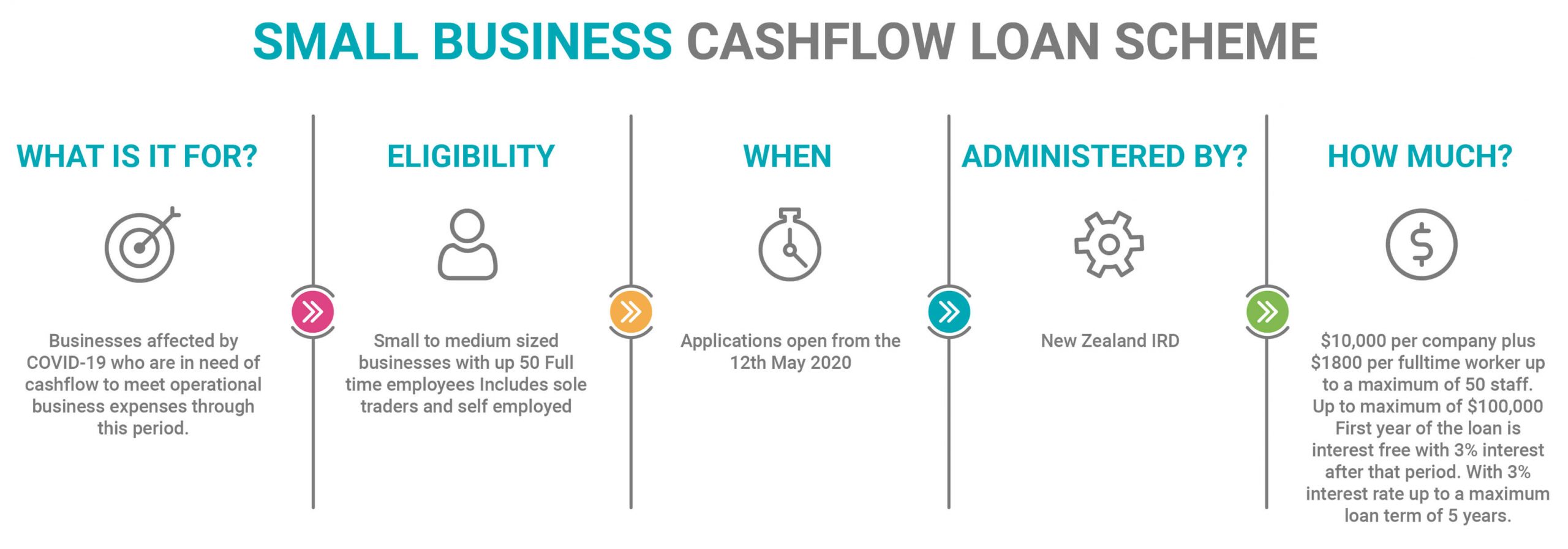

During Covid19 the government announced a range of measures to assist businesses and I hope that everyone applied for assistance as it was required for your business. These include changes to tax loss continuity rules, tax loss carry-back scheme, business consultancy support and the small business cashflow loan. The Small Business Cashflow Loan (SBCS) was setup to support small to medium businesses that were affected by Covid19.

The reason for writing about the SBCS that was originally been extended to 31 December 2020 is that on the 10th November the Government announced updates to the scheme.

The following changes are to be made to the scheme:

- No interest is to be charged on the loan if it is repaid within one year. This is to be increased to two years.

- The loan was to be used only for core operating costs. This is to be broadened and will allow the loan to be used for capital items such as fixed assets.

- Applications for the loan can now be made up until the 31st December 2023 which is an extension of three years.

The above changes will be made by Inland Revenue and should be done by the 31st December 2020 and all other aspects of the loan remain the same.

- SMEs with 50 or fewer FTEs

- You must have been in business on the 1st April 2020 and had a 30% drop in revenue as a result of Covid19

- The maximum that can be borrowed is $10,000 plus $1,800 per FTE

- The loan period is for 5 years and the interest rate is 3%.

All current loans will be updated with the above changes. Further changes maybe made to the loan as the government has asked for advice on some of the current aspects of the loan.

Current information on the loan can be found here and will be updated as the changes come into effect.