5 Balance sheet Apps To Help Manage Your Business

Apart from Forecasting apps, there aren’t a lot of balance sheet apps however I have found a few interesting ones to look at. If Xero’s standard balance sheet features, like their fixed asset component, doen’t quite meet your needs there are add-ons that integrate well with Xero that have extra features and are built to handle more assets. I have included several asset management tools below, including one industry specific example and several loan application options that integrate with both Xero and MYOB Live which will help save you time on applications.

This post may contain affiliate links which means I receive a small commission at no cost to you when you make a purchase

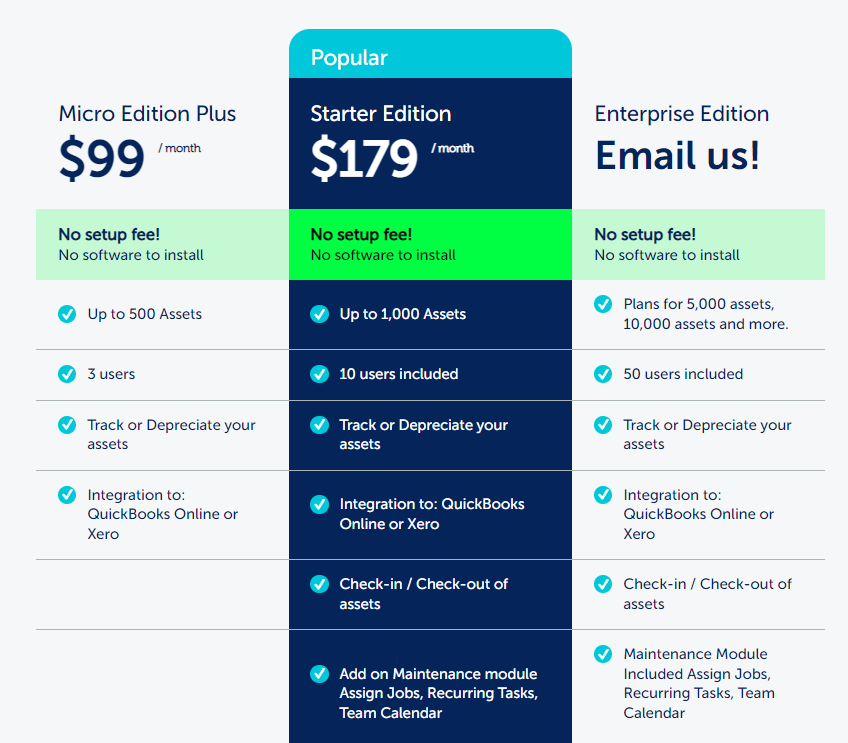

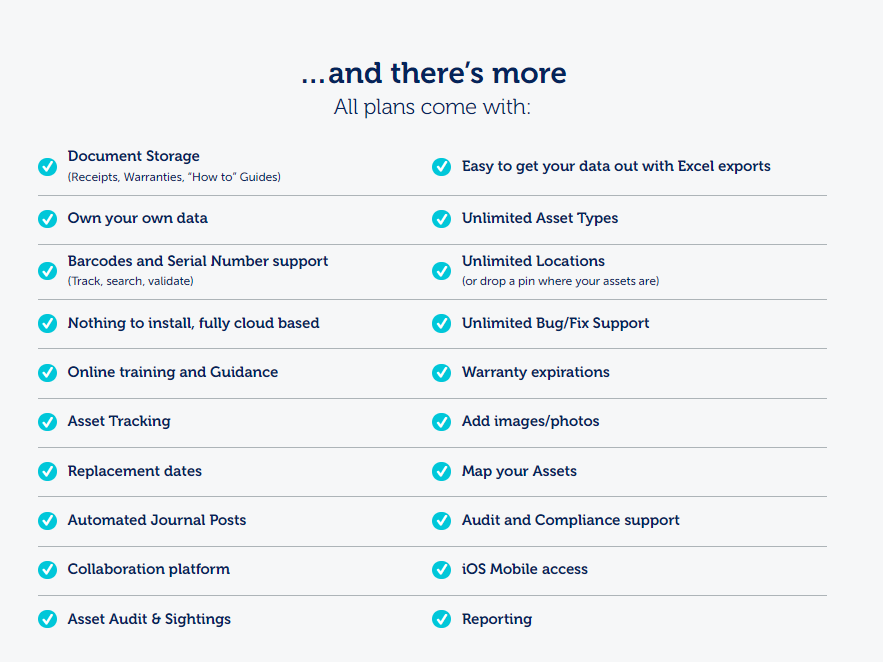

Are your assets becoming unmanageable in Xero. Once you get over 500 assets in Xero the depreciation schedule is quite a few pages long and hard to keep track of. Asset.Guru is made to extend your Xero and has the ability to track between 500 & 20,000 assets and it will post automatic depreciation and even import draft assets into Asset.Guru from Xero.

It even allows assets to be checked in/out by staff, asset revaluations and asset audits. Track certifications, maintenance records and track how assets have performed over time. Being able to track what staff member has what laptop or company car can make it easy to ensure company assets are returned when a staff member leaves. Invoices, loan documents etc can all be uploaded against the asset making it all easier to find when needed.

Asset.Guru currently integrates with either Xero or Quickbooks for accounting and will soon integrate with Slack. There is also a current integration with Bill.com.

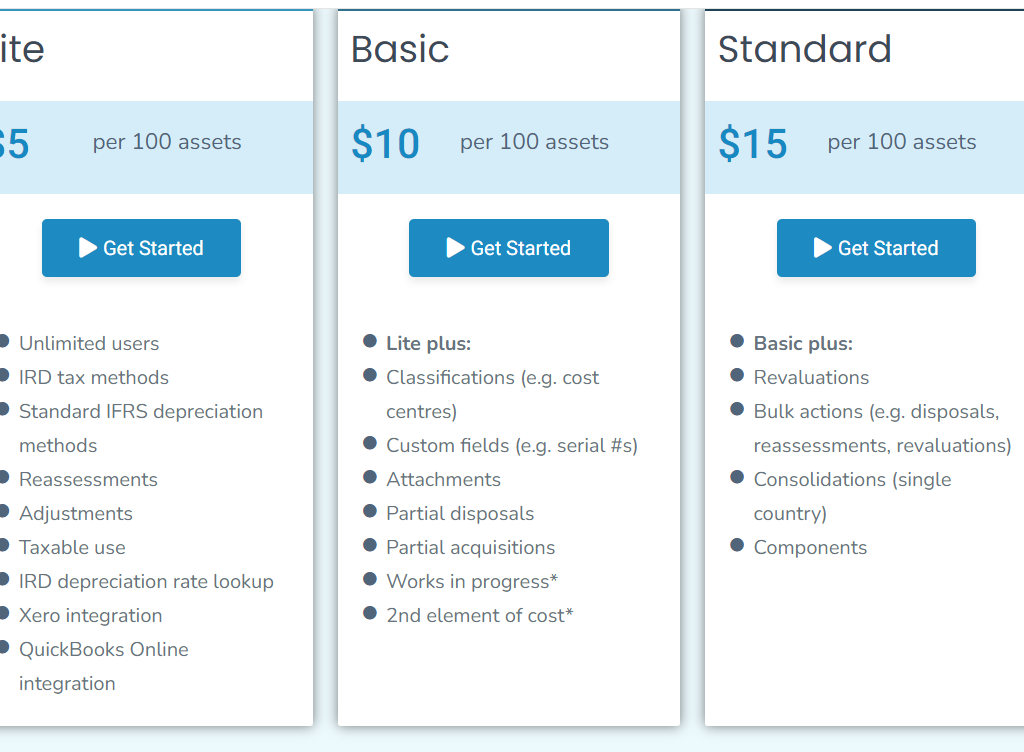

Asset accountant is similar to Asset.Guru however is also good for calculating IFRS compliance and lease accounting. It allows for partial acquisitions and disposals of assets which can be really handy if you buy 20 chairs which are registered as one asset and can then dispose of 10 later. Partial disposals are not currently available within xero’s fixed asset register.

The software has quite a few accounting integrations including – Xero, Sage, Quickbooks, Dynamics and more. With automatic IRD depreciation rate lookup, automatic fixed asset detection and automatic depreciation calculation it makes maintaining fixed assets easy.

Hire purchases and finance leases are made easy with the generation of payment schedules and Asset Accountant will ensure those that need to be are compliant with IFRS16 which anyone that needs to comply with knows how painful the calculations can be.

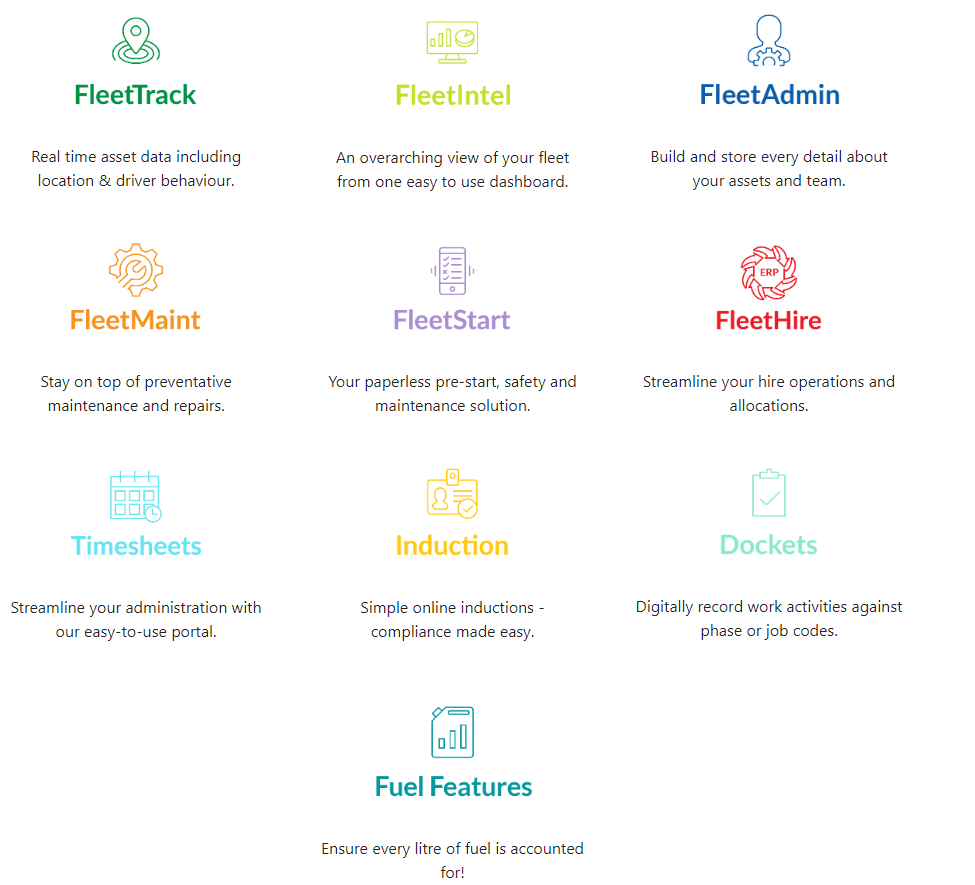

The Fleet Office specialises in tracking, compliance, Maintenance, hire and electronic timesheets and dockets. The Fleet admin section contains an unlimited asset register, asset QR codes, automated alerts and reports, risk assessment prestart integration and storage plus lots more.

Having a good asset management system is ideal however if you have a trucking company or heavy machinery business having an app tailored to your industry will help provide extra information. In this case, being able to track fuel efficiency and report on driver behaviour as well as making your business paperless can save you time and money. With various integrations including xero, it will help keep your assets managed etc. Pricing is very customised so head over to their pricing page to see the options.

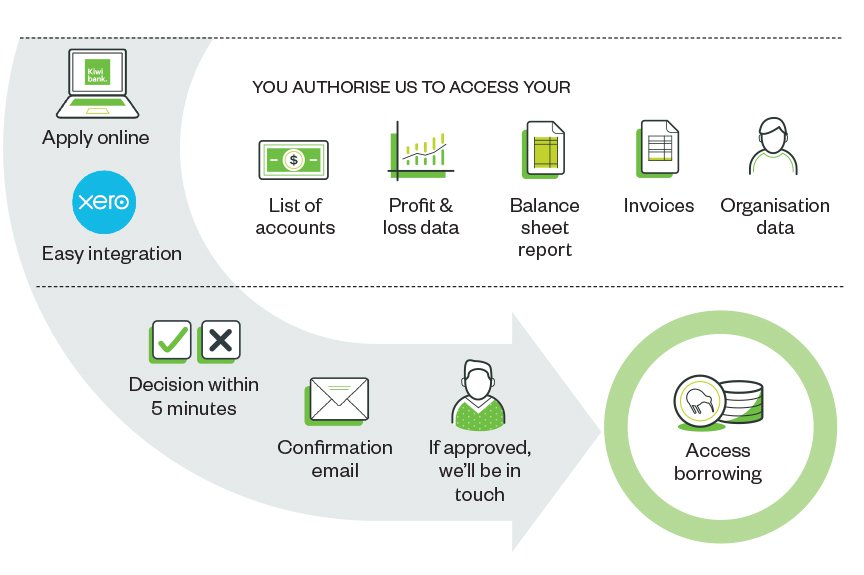

Kiwibank & Xero or MYOB Live have integrated with the Kiwibank Fast Capital app which is a quick and easy application process to get a fast decision on borrowing for your business – without all the paperwork. To use the app you need to be the director of an NZ registered company with at least 2 years of financial data already in Xero. The app allows you to apply for a business overdraft, loan or credit card with a limit of up to $100,000, without the hassle of providing extra documentation.

When you submit your application for one of the options above you also authorise Kiwibank to access your xero or MYOB Live data which they can then use to make a decision on whether or not to lend to your company.

By using the Kiwibank Fast Capital app you will save time and reduce the amount of work you need to do to get your loan however you need to ensure that all your data is up-to-date for the bank to access your eligibility. Using the app won’t automatically add the account to your Xero this will still need to be added through the add bank account option in Xero once approved.

ANZ has also teamed up with Xero & MYOB for the ANZ NZ GoBiz online application. You are eligible to apply for a loan or overdraft online if:

- you are a sole trade or a company with up to 5 directors

- Have been using Xero or MYOB Live (in NZD) for 2 years or more.

Using GoBiz you can apply for a secured loan up to $500,000 or an unsecured loan up to $250,000. These amounts include any amounts already loaned by our bank. So if you already have a $100,000 secured loan from ANZ you can still apply for another $400,000.

By using the ANZ GoBiz application you will save time and reduce the amount of work you need to do to get your loan however you need to ensure that all your data is up-to-date for the bank to access your eligibility. Using the app won’t automatically add the account to your Xero this will still need to be added through the add bank account option in Xero once approved.