Freshbooks & Xero. Which software is right for your business?

What is the right accounting software for a business? is a hot topic at the moment especially with Xero increasing their pricing in September 2022 for all business plans and March 2023 for their partner plans. In this article we will look at the features of Freshbooks & Xero.

This post may contain affiliate links which means I receive a small commission at no cost to you when you make a purchase

A lot of small business owners aren’t interested in the bookkeeping side of business. It’s a time consuming task that doesn’t bring in money. Using an accounting system will increase efficiency in a business however choosing the right software can be difficult. What features do you need in a software and what price structure will best suit your business?

We will compare Xero which is the most popular small business accounting software in NZ at the moment and Freshbooks which is a newcomer to the NZ market in the last month. They both offer unique features, we will compare these to help you choose the right software for your business.

Features

Both Xero and Freshbooks have all the basic features you would expect in an accounting software and are both cloud-based, however each software can require a different process to complete the same task. We compare the following features:

- Pricing

- Setup Process

- Invoicing

- Bank Reconciliation

- Reporting

- Dashboards

- Bonus Features

- Add ons

If Xero is the right software for you, we have a Xero Basics for Business course.

Pricing

Freshbooks

| Plan | Price | Clients | Features |

| Starter | $5* | 2 | Send 2 invoices per month to up to 2 clients |

| Lite | $15* | 5 | Send unlimited invoices per month to up to 5 Clients |

| Plus | $25* | 50 | Send unlimited invoices per month to up to 50 Clients |

| Premium | $45* | Unlimited | Send unlimited invoices per month to unlimited Clients |

Xero

| Plan | Price | Features |

| Starter | $31* | Send up to 20 invoices and enter 5 bills. |

| Standard | $66* | Send unlimited invoices and enter unlimited bills. Includes Hubdoc. |

| Premium | $84* | Includes the above plus multi currency. |

| Ultimate | $95* | includes the above plus payroll, expenses and projects for 5 people plus more. |

Price wise Freshbooks is definately cheaper as the Plus plan for $25 per month to invoice 50 clients would suit a lot of service businesses, which is approx $51 dollars cheaper than the equivalent Xero plan. However the prices for Freshbooks are only for 1 user, if you need to add more users it is $10 per user. Check the yearly pricing as I was offered 10% discount if I paid yearly which made the Plus plan $270 for the year.

Setup Process

Both apps have setup wizards which help you through the setup process and are eay to use. They allow you to customise your chart of accounts, however in freshbooks you can’t add extra equity accounts, only an accountant can do this.

If you are unsure of what needs doing go to one of our courses to help you through the process.

Invoicing

Both Xero and Freshbooks offer great invoicing features that can be customised. Payment services can be integrated to either software making receiving payments easy.

Freshbooks was originally an invoicing app so has some extra features like being able to add late payment fees that automatically calculate. It does not provide the ability to create a fully customised invoice like xero however there are several templates to chose from.

Xero allows full customisation of invoices through .docx templates. Templates can include packaging slips, barcodes or QR codes and the addition of extra columns. We have created quite a few custom templates for clients especially if they have moved from a different software to xero and want the invoicing to look the same as before. We have also created a course to show you how to create your own custom Xero templates.

Bank Reconciliation

Both apps have bankfeed capability, depending on what bank your accounts are with will depend on if these can be connected.

All Xero Business Plans include bankfeed and bank reconciliation capabilities. ASB accounts can be connected only and usually start the next day however other accounts can take up to 10 working days to get connected. The bank accounts have ai technology which memorises where you have coded transactions for a supplier previously and will suggest that account the next time the supplier comes up. Transactions can be created or matched to invoices and bills already entered. Bulk cash coding can be used in all Business plans except the Starter plan.

Freshbooks bankfeed connect is also easy to setup and the ASB feeds came through within about 10 minutes after setup. However, bank reconciliation isn’t as easy as in Xero. Invoices and bills/expenses need to be added into the system to match the transactions to.

Reporting

You will find all the basic reports in both apps such as a profit & loss report, balance sheet, aged receivables and payables and GST reports if you are GST registered.

Freshbooks can run GST reports in different countries if you are registered in multiple countries. All plans include multi currency however it does not do currency conversions so if you invoice in $USD you will need to run reports for $USD and seprate ones for $NZD then covert the $USD amounts into $NZD and combine the two reports.

Xero has a huge amounts of reports available and when on the reporting screen these are split out into separate categories. All reports can also be heavily customised to include budgets, formulas and tracked income & expenses.

If standard reports is all your business will need, freshbooks could work for you however if you want complex reports that are easy to run Xero would be better for your business.

Dashboards

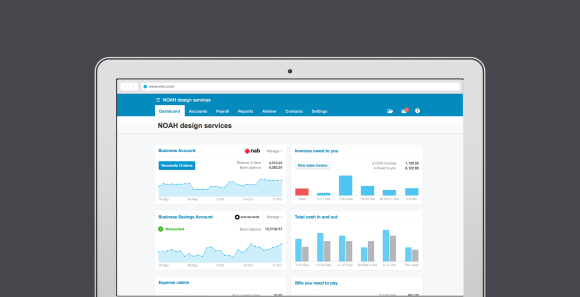

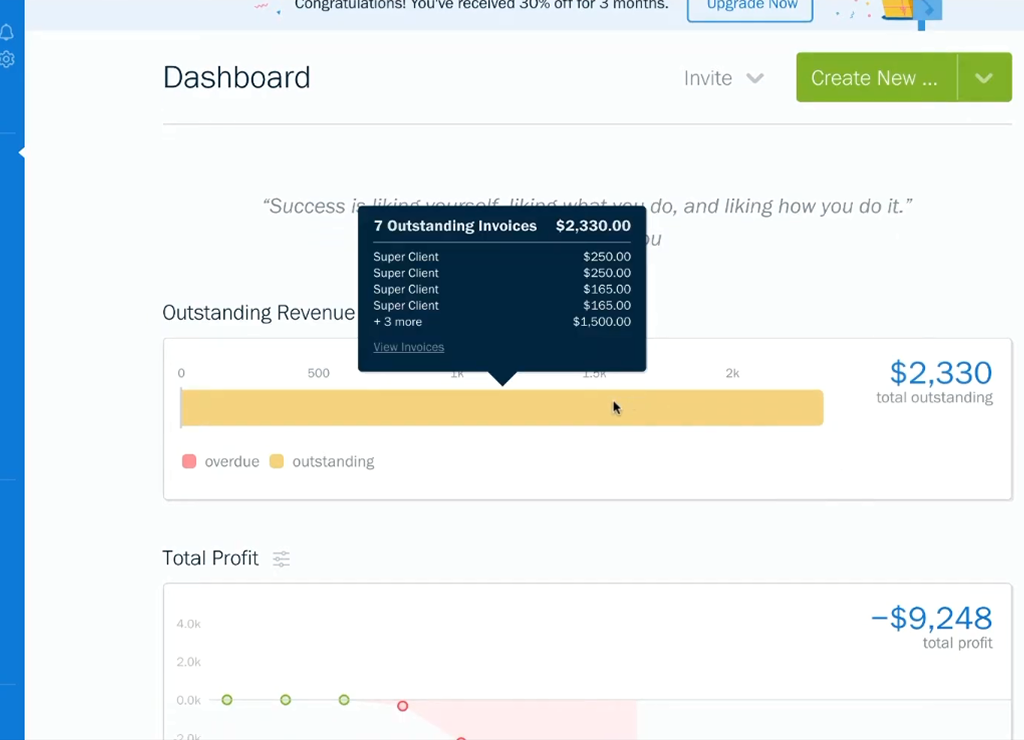

Both Xero and Freshbooks have user-friendly dashboards which show very similar information. You may prefer one dashboard over the other and both a easy to use.

Bonus Features

Freshbooks

Time tracking, project management and multi currency is available on all plans. The multi currency does not provide currency conversion so this will need to be done manually and reports for each currency are run separately.

All these extras that are included in the plan in Freshbooks are add ons that are billed separately in Xero.

Add ons

Xero has 1000+ add-ons available to make their accounting system more comprehensive. If you have a large inventory in your business you won’t want to use the inventory system built into the software, as it is not built to deal with a large inventory. A system such as Unleashed, or Cin7 would be good options to look at.

The Xero app marketplace is the place to go to look at what addons are available.

Freshbooks has 100+ add ons available in their app store. These include apps for appoinmtent booking, create proposals, manage teams and payroll. Some of the apps that you find the Xero marketplace are also available in the Freshbooks aap store such as G-Accon, Mailchimp and Woocommerce.

The software that is right for your business will depend on what features you will use, what industry you are in and whether price is important. While there is considerable overlap in the functionality of these apps, Xero and Freshbooks are very different products. Both have free trials to let you use the software and see what you like best.

Freshbooks is most suited to service based professionals or those that want a cheap invoicing app that has some extra functionality. Read our Freshbooks article for more information on the app.

Xero is more popular in NZ at the moment as it has been around here a lot longer. It also has the most comprehensive features of the two, with it’s easy-to-use bank reconciliation, customisable reports and inventory system. Xero is the best choice if you need a full function software or need additional apps. We also have a few articles on Xero and some add-ons.

If you want to know more about Freshbooks we have a Masterclass course.

Learn how to:

- Setup Freshbooks

- Reconcile Bank Accounts

- Create Invoices

- Run reports – including GST reports

- and much, much more

For Xero we also have a Xero if you already know the basics we have created an invoice customisation course and also have some courses on xero add ons.