Profit & Loss Reporting for Business

What is a profit & loss report? and why do I need to look at one?

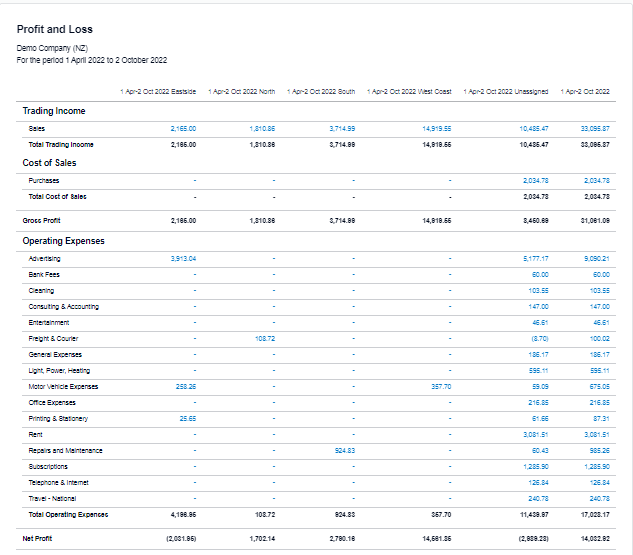

These are questions that I hear frequently. To be successful in business all owners should be regularly be checking this report. The report can also be known by several different names depending on the country you are from. These names include – Statement of Financial Performance, Statement of Operations, Income Statement or P&L. What the report is called doesn’t matter, the main purpose is to list your business’s income and expenses and show the difference between the two.

This post may contain affiliate links which means I receive a small commission at no cost to you when you make a purchase

What is a Profit & Loss Report?

A profit & loss report shows the business’s income and expenses over a specific time period, this is typically a month, a quarter or a year. These figures will show if you have made a profit or loss during the specified period and allows you to make adjustments to your spending or sales strategies.

The information that is required for this report includes:

- Bank statements for all business accounts and credit cards listing all transactions

- Any petty cash transactions

- Any cash received that hasn’t been banked

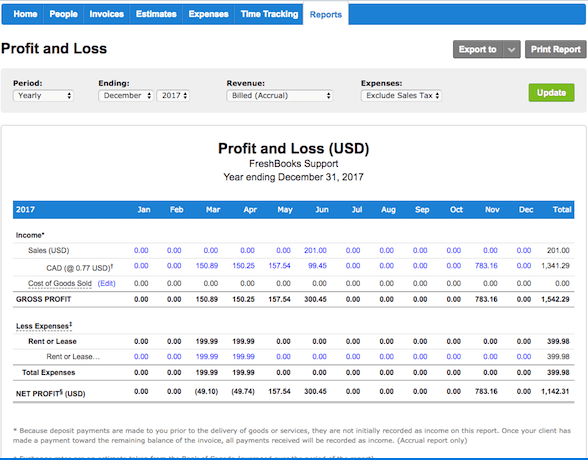

If you are using accounting software such as Xero, MYOB or Freshbooks etc this report eill be included in their standard reports and will allow you to run the report with a click of a button. However this can be calculated on a spreadsheet if you have a smaller business.

The goal of this report is to provide an overview of the financial health of the business through using a basic formula.

Another reason to generate this report is it will give you the figure that you are required to file with IRD in your tax return so they can assess the tax owed on your income. If you require finance at any time, the bank or finance company will require reports including a Profit & Loss report to see how the business has been doing and if the business can viably pay back the loan.

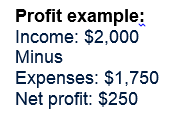

Revenue – Expenses = Net Profit (Net Loss)

This report also allows you to investigate revenue and expense trends, by comparing them to prior periods. Keep an eye on net income and the overall profitabiliy of the business which will then allow you to allocate resources and budgets accordingly.

How is a Profit & Loss Report Calculated?

To calculate simply:

- add together all your sales for the period

- Add together all your expenses for the period

- Subtract the total expenses from total income

- The difference is your profit or loss

Components of a Profit and Loss Report

More complex profit & loss reports can be generated which include extra formulas for Gross profit. The use of accounting software like Xero can alow you to easily track different income streams and the expenses that relate them. I have included the most common sections and formulas below:

- Revenue: This should include all income earned from the primary business activites.

- Cost of Goods Sold: This is the cost to produce the products or Services. It also includes opening and closing stock for the period.

- Gross Profit: This calculated by Revenue – Cost of Goods sold. The Gross Profit should be positive, which means there should be enough money to cover all expenses with money left over for profit. If this is negative your products or services are costing more to make than you are earning from selling them. This means there will be no money left over to cover operating costs let alone make a profit. You will need to raise prices or use cheaper materials. Speak to an advisor urgently. Read our article on Pricing strategies to ensure you are pricing correctly.

- Other Income: This usually includes any income not earned through the business’s primary activity. e.g. Interest received, grants or wage subsidies and dividends received etc

- Expenses: These include any business related expenses that are related to the running of the business. Which can include: rental expenses, payroll, accounting fees, marketing, subcontractors etc. Depending on whether you want to calculate EBITDA non-cash expenses such as depreciation can also be included in this section or separated into it’s own section.

- Net Profit or Loss: This is the total amount earned after deducting all expenses. To calculate net profit, subtract the total expenses from your gross profit.

Extras to know for the Profit & Loss Report

The Profit & Loss statement is Accrual Based

In New Zealand for end of year Financial Statements this report is always run on accrual basis, not Cash basis. This means that any invoices that you haven’t received the payment for yet are also included in your P&L statement. This provides the most accurate view of how your business is performing. However you can run this on cash basis for internal report.

What isn’t included in the P&L

THe Profit & Loss doesn’t inclue:

- Any personal expenses

- any capital items (assets over $1000, intangible assets etc)

- any loans or repaymnets of loans (only includes the interest on the loan.

What is the difference between a Profit & Loss Report and a Balance Sheet?

A P&L report shows a business’s income, expenses and profit over time. Whereas a balance sheet provides a snapshot of its assest and liabilities on a certain date. Read our article on balance sheets to learn more about these.