What everyone should know about Income Tax!

Income Tax, Provisional tax, Terminal Tax, Residual Income Tax.

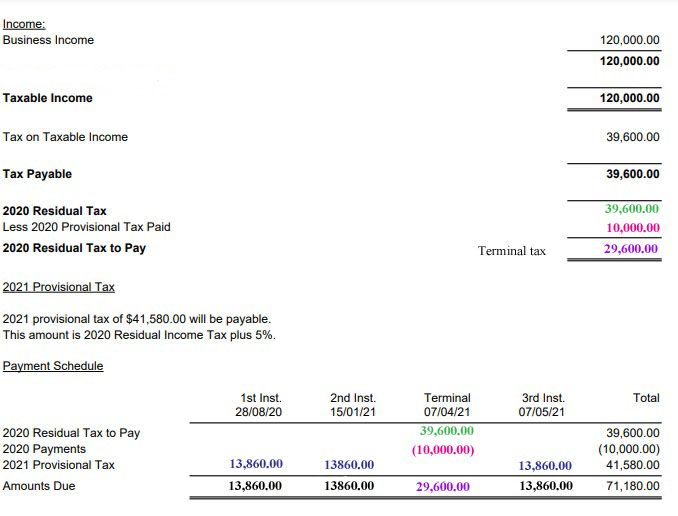

What are all these taxes? and How much tax am I going to have to pay? All these names relate to Income Tax. Provisional tax information is below and is just a way to help pay your income tax for the year. Terminal tax and residual income tax are the same as you will see in the below image and is the amount due after your provisional tax payments are subtracted from the total tax due. I have provided a sample return below to show how the terminal and provisional tax payments work.

What is provisional tax?

Provisional tax is a way of paying your annual income tax for businesses, sole traders, trusts etc. You pay it instalments during the year instead of in a lump sum at the end of the year. Provisional tax will only be payable if you had to pay more than $5,000 income tax at the end of the year that your last return was filed. Some contractors will have tax deducted from their pay (scheduler payments which will be discussed in a separate article).

If you are required to pay provisional tax the first payment may be due soon after you have filed your tax return. If you don’t have an accountant or your extension of time has been removed your income tax return needs to be filed by the 7th July. This gives you 3 months to collate your information and file the return.

There are four options available for calculating provisional tax.

1. Standard option– is the most commonly used and IRD’s default option. It is useful if your income is steady or increases over the next year. Calculated by your last years tax to pay + 5% (or tax to pay from prior year return + 10% if you haven’t filed the most recent return)

2. Estimation option – is not commonly used as if you estimate to low you may incur penalties and interest on the shortfall. Useful if you know your income will decrease in the next year.

3. Accounting Income Method (AIM) – this is a new option the was started recently and works through accounting software. You will pay small amounts more frequently based on the current years cashflow. This is calculated through your software each time your GST is calculated.

4. Ratio option – this is useful if you’re GST registered, file monthly or 2 monthly returns and your income tends to vary.

Payment Dates

These will vary depending on the option chosen, GST registered or not, and the filing frequency. Payment due dates can be found here. . You will also be able to see your due dates when you login to MYir and click on the period in which provisional tax would be due.

Your provisional tax due dates for AIM will be the same as your GST dates monthly or two-monthly. If you use the standard or estimation option, you’ll usually pay provisional tax in three instalments, in August, January and May. If you file GST six-monthly, you’ll pay two instalments of provisional tax, in October and May. For the ratio option you will pay in six instalments throughout the year.

When you file your income tax return and calculate your tax for the year, you deduct the provisional tax you paid earlier. If your provisional tax paid is more than your RIT, you’ll get a refund and may receive interest on the difference. In some cases, if your provisional tax paid is less than your RIT, Inland Revenue may charge you interest on the amount owing and a penalty.

Sole trader

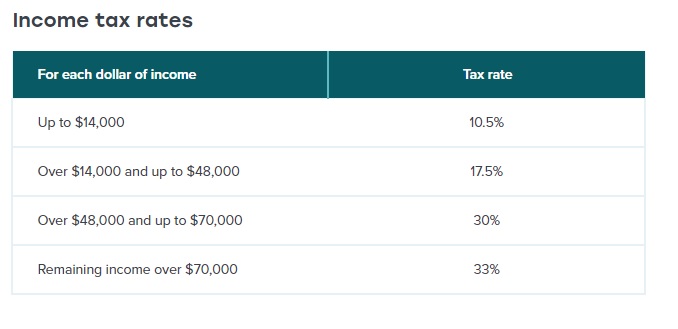

Income tax is calculated on a tiered scale shown below. IRD has an online calculator that allows you to type in your income and it will show how much tax you owe. This can be accessed here.

Sole traders need to file an IR3 and an IR10 should also be included which summarises your income and expenses.

Partnership

Partnerships do not pay income tax, as all profits are distributed to the partners. The partners then pay tax under their personal IRD numbers at the above tiered tax rates.

Partners can take a wage or salary that has PAYE deducted depending on what is stated in their partnership agreement.

The partnership will need to file an IR7 and an IR10. Partners will then need to file their own individual IR3’s with their partnership income included.

Companies

Any profit left in a company is taxed at the flat tax rate of 28%. An IR4 and IR10 will then need to be filed for the company. IRD may require tax returns for the shareholders (IR3) that include any shareholders salary that they received from the company.

Trusts

A trust is taxed at a flat tax rate of 33%. An IR6 and an IR10 should be filed for this type of entity. Trust income can be allocated to beneficiares who will then be taxed at their personal tax rate.

If you are filing your own returns these can all be filed through IRD’s MYir, otherwise your accountant will send you all relevant returns for you to sign and they will file these on your behalf.

One Comment