Which is the best bank account for my business?

The question of which is the best bank account for mybusiness? is one of the most asked questions that I see in facebook business groups and there is no one size fits all answer to this question.

All banks offer different prices for their services so each should be considered however most people will setup business accounts with the bank that also has their personal banking.

Sole Trader

Sole traders have the benefit of being able to use a personal bank account, however ensure you setup one that is exclusively used for your business. This makes it tidier for your accountant at the end of the year when your accounts need to be done. So if you are going to trade as a sole trader the best bank account for your business would be one that has no fees and these are a lot easier to setup than a business account.

Companies

Once you have registered your company a business account should be setup. I have seen many people who run their company accounts through accounts in their own name however a company is meant to be a separate legal entity and as such should have bank accounts in the company name. This will mean that any debts for overdrafts etc are owed by the company and are not under your own name.

Click the bank logos to go directly to their business banking pages.

ANZ offers a business startup package if you are in your first two years of business which provides the following:

– Transaction and monthly account fees will be waived on ANZ Business Current account for the first 12 months

– Monthly account fees will be waived on an ANZ flexible facility for the first 12 months

– The annual fee for an ANZ Visa Business card will also be waived for the first 12 months

You can also talk about the following depending on your business needs:

– Business overdraft or Business loan – short or long term lending

– ANZ Fastpay to help get paid faster

– 12 months free MYOB Essentials or Accountright

Their website also provides several guides for business start-ups and resources.

ASB offers the Business Focus Package which is designed for small businesses with a turnover of less than $2 million. You can tailor the package to suit your needs

The small business banking options gives business guides and options that the bank provides including their free app Vonto. This draws data from xero and other business tools and provides the information using easy to understand language straight to your phone.

BNZ offers different packages for different sized businesses and has a separate option for Agribusiness. Their website allows you to compare transaction accounts and cards to ensure you get the right fit for your business.

MyBusiness Live is a smart dashboard to show you how different parts of your business are performing. It displays insight from your business apps – Xero, MYOB, Shopify, Facebook and google analytics in one place and can be customised to your business and industry. This is a free addition.

Kiwibank offers different accounts and finance options with all information available on their website. There is also a few articles on starting a business.

Westpac offers several options for businesses including the bizpac package. This is an all-in-one package designed specifically for businesses with an annual turnover of less than $2 million. This package provides the following:

– Unlimited transactions for $10 monthly account fee

– All banking essentials including an overdraft to smart payment solutions

– Plus more

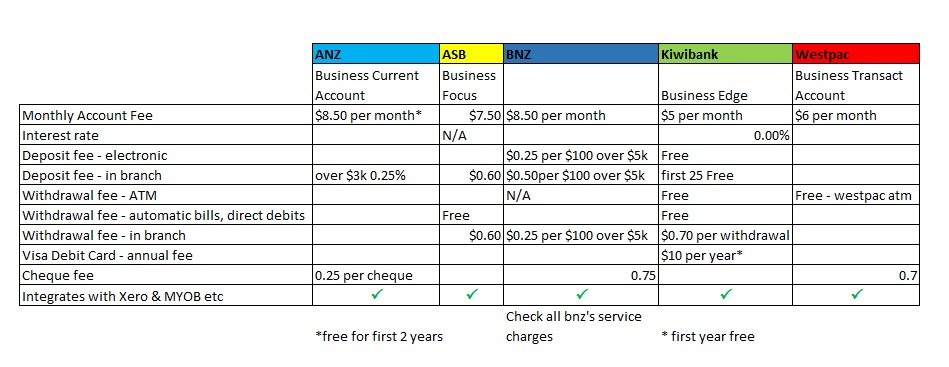

Only you are able to decide which will be the best bank, account or package for your business. I have included a comparison chart of fees etc for some of the options listed above and some different accounts. Make sure you check all terms and conditions on the accounts and packages you are considering. All prices and fees are subject to change however were correct at time of writing this article.