Why is a Balance Sheet Important?

A Balance sheet report or Statement of Financial Position includes all assets and liabilities owned by a business at a specific point in time. It is one of the three core financial reports that are used to evaluate a business. The balance sheet can be used to calculate ratios such as rate of return on investment, debt-to-equity, working capital and many more.

This post may contain affiliate links which means I receive a small commission at no cost to you when you make a purchase

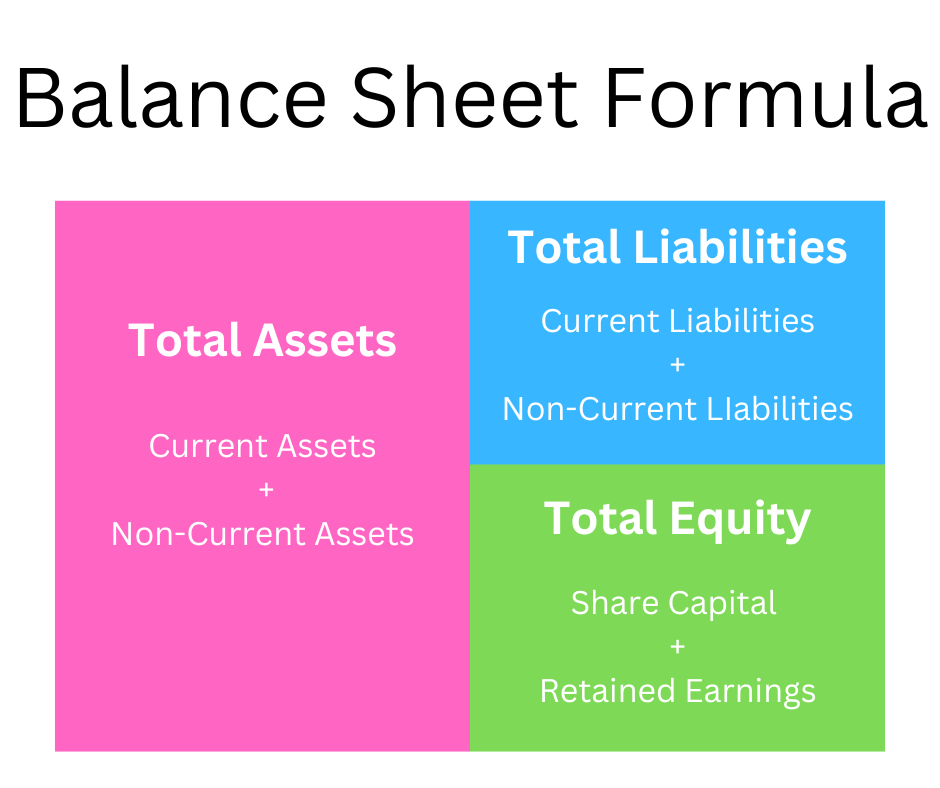

How the Balance Sheet works

The balance sheet is calculated using the below formula. The formula is intuitive and is formed using double entry accounting. This shows as when a company buys new assets e.g. a new vehicle it does this by reducing the bank account or by taking out a loan (liability) against the asset.

If the Company purchases a new ute for $60,000 and pays $10,000 cash and the rest on loan, it has the following effect on the balance sheet. Fixed assets increase by $60,000, the bank account decreases by $10,000 and the liabilities (loan) will increase by $50,000. These transactions in both the asset and liabilities sections balance the two sides of the equation. (For ease of explanation GST has been left out of this calculation).

The assets should always equal the liabilities + equity, meaning the balance sheet should always balance. If it doesn’t there may be an error in calculation or misplaced data. If you use accounting software this will auto calculate and should equal, if it doesn’t an account may have been moved from an asset to a liability incorrectly and causes a calculation error.

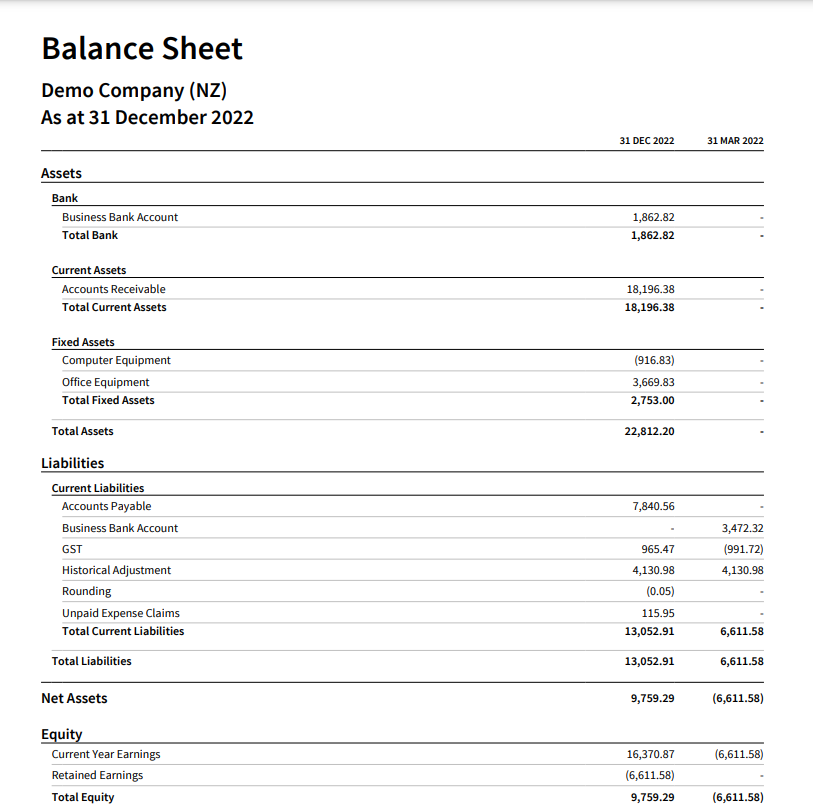

Sections of a Balance Sheet

Assets

Assets are broken down into two categories – current & non-current assets. Current assets include those that can be converted into cash easily or will be within one year.

- Cash & Cash equivalents – This includes bank accounts, short term deposits and petty cash etc

- Accounts receivable – Money owed by customers of the business, sales on account

- Inventory – stock held by the business for sale. This is included at the lower of cost or market value

- Prepaid Expenses – Any expenses paid in advance for example rent, advertising contracts, insurance etc

Non-Current Assets

- long-term investments that cannot or will not be liquidated in the next year. Investment portfolios, loans to other businesses

- Fixed assets – including land & buildings, Motor vehicles, plant & equipment, office equipment etc

- Intangible assets – this includes goodwill and intellectual property. Such items are usually only included on the balance sheet when purchasing a pre-existing business not when they have been developed in-house.

Liabilities

A liability is any money that is owed to other businesses, from suppliers to loans that need to be repaid. Current liabilities are those that are due within one year and are usually listed in order of due dates. Any non-current liabilities are those that are due in more than one year.

- Credit cards – these are one of the most common liabilities

- Accounts payable – These are bills that the business receives in the course of trading and are usually due within 20-30 days after receiving.

- Unearned Revenue – this is prepayments received from customers before starting a job and will be allocated to invoices as they are created.

- Tax Payable – Tax payments due to be made within the next year.

- GST Payable – The current outstanding balance of GST owed.

- Wages Payable – wages processed however not yet paid. This will usually be the prior weeks pay.

- PAYE Payable – As this is due the 20th of the following month, if you have staff this will usually be shown on the balance sheet dependent on the payroll service that you use.

- Current portion of loans – this is usually calculated by your accountant at the end of the financial year for the next year as accounting software does not auto-calculate this. This is the portion of any loans due in the next 12-months.

Non-Current Liabilities

- Loans – this is the loan balance less the current portion listed above.

- Shareholder Current Accounts – these are usually a non-current liability as they are unlikely to be repaid to the shareholders within one year. (where this sits can depend on how you have set up your Chart of Accounts and how your accountant sets up their reports).

Equity

Retained Earnings

Retained earnings is the net profit of the business after tax. These can be used to reinvest in the company or can be used to pay down debt. Any remaining amount can be distributed to the shareholders at a later date by declaring a dividend.

Share Capital

This is usually listed in NZ as the number of shares issued in the company dependent on the value of those shares. Most companies list the value at $1 per share, so a company with 100 shares would have a share capital or issued capital account with the value of $100 in it.

Why should your Business have a Balance Sheet?

Regardless of the size of your business, you should have an up-to-date balance sheet. It will ensure that you keep track of the businesses assets and liabilities, you can quickly determine if you have taken on too much debt or don’t have enough current assets that can be liquidated in an emergency or enough cash to meet your current needs.

If you are after funding or a business loan, most lenders will want to see your balance sheet to determine whether you will be able to repay any debt off if the business is worth investing money into. Some investors will want to calculate specific ratios to ensure the business is viable and to do this they will require figures from the balance sheet. If you have a business manager they will want to view the balance sheet to keep see if there are any improvements they can make to the business from the information provided on there.

Are there any limitations to a Balance Sheet?

Yes. As the Balance sheet is static and shows the figures at a point in time usually a Profit & Loss report and a Statement of Cash Flows is used to get a full picture of how a company is tracking. A Balance Sheet alone will not be able to show a complete picture of the profitability of a business.

Due to the report showing the balances on a particular day, just viewing the balance sheet can make it difficult to assess the viability of a business. For example, if a company showed cash of hand of $200,000 at the end of the month. Without knowing the previous months closing balance, comparative point or industry demands, knowing how much cash the business has on hand at the end of the month has very little value.

The use of different accounting software can have different calculations for depreciation and treatment for inventory. Using an add-on may keep your inventory figures in your accounting software up-to-date however others require the figures to be manually entered monthly. Accounts Receivable also needs to be assessed frequently to determine if any of the outstanding amounts may become uncollectable.

A balance sheet may seem unimportant if your business is small however if you want to expand your business at a later stage, look at selling your business or look at getting an investor in. Having an up-to-date balance sheet and having previous data to compare to will give you the financial data that you will need easily at hand. Having an accounting software will help you to easily retrieve this information. If you don’t already have an accounting software check out our article on the importance of accounting software or our article on the different software available. Business.govt.nz also has some great information on how to read Balance sheets and a sample of one.